Risk, peril and hazard are all terms used in homeowners insurance. Catastrophe insurance is a type of homeowners coverage that can help you with emergency medical costs resulting from a named peril. For more information on catastrophe insurance, here are the basics:

In most homeowners insurance policies, only specific hazards will be covered and may vary by policy or insurer. Catastrophe insurance is an optional addition, or rider, you can include in a homeowners policy to help cover health costs related to a disaster.

Homeowners insurance protects your personal property against damage. It can also financially protect you and your household from unforeseen injuries caused by your own residence. However, only catastrophic insurance riders will provide broad coverage for emergency medical expenses.

It's crucial to know which hazards are included in your particular policy, and also the limits of your health insurance coverage. Injuries sustained in a natural disaster can make a difficult situation even worse. The more you can do to protect yourself and your finances, the better.

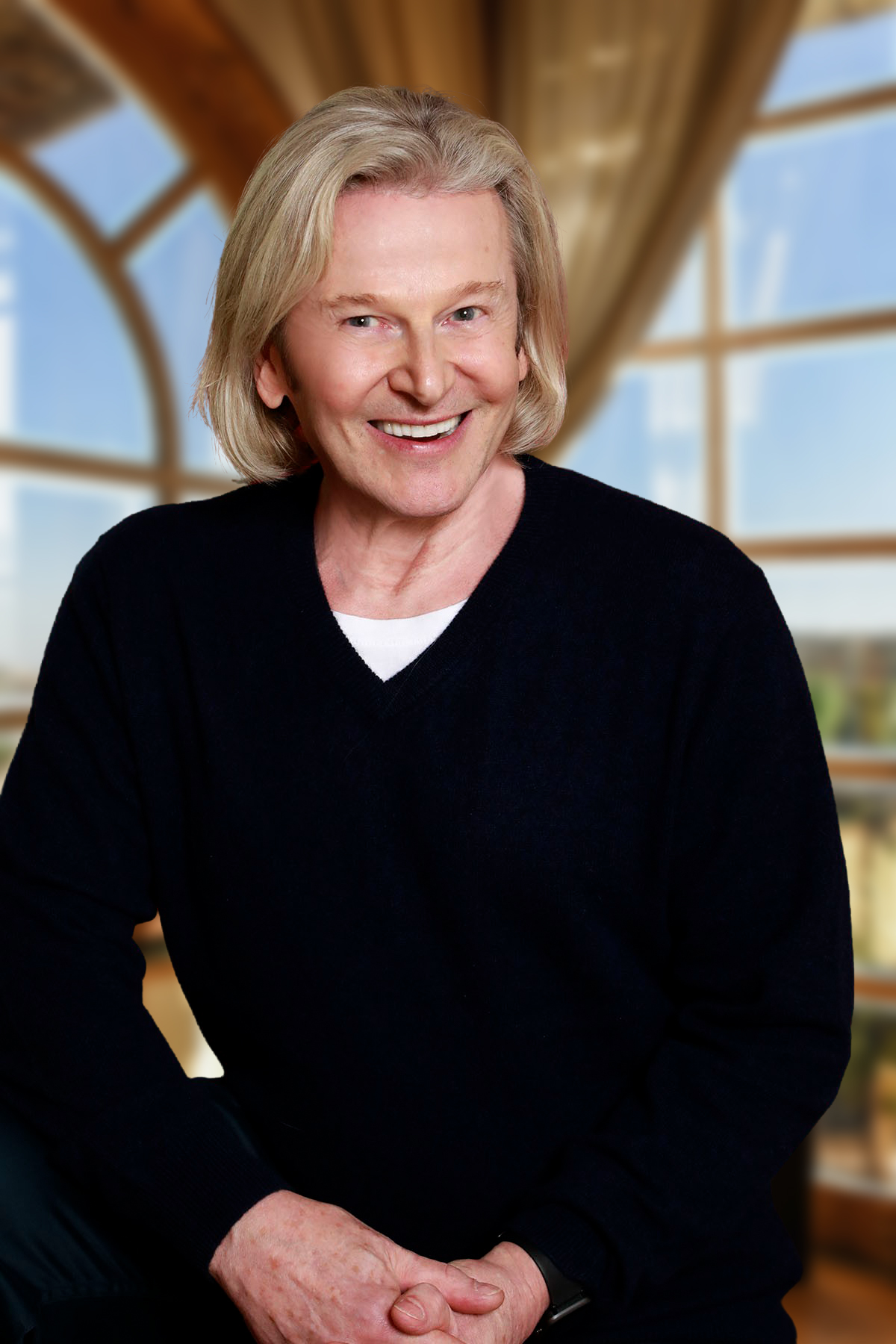

It's Just Not Possible To Look For A Home In An Older "In-Town" Neighborhood Near Duke University And Not Come Across The Iconic Oval Sign For "Tim Hock Properties". Often Said To List Some Of The Most Beautiful Homes In Durham, Tim Has Turned Buying & Selling A Certain Type Of Home Into An Art Form.

If Asked, Tim Will Tell You, "I Have The Best Job And The Best Clients In The World, Working In A City I Know & Love, Doing What I Want To Do And Being Allowed To Always Do It Very, Very Well. Nothing Makes Me Happier Than Walking By A Former Listing And Seeing How Well The Builder's Design Decisions Have Timelessly Aged. "And, To Know I Had A Small Part Of The Final Outcome Of The Finished Product Is Very Fulfilling To Me."